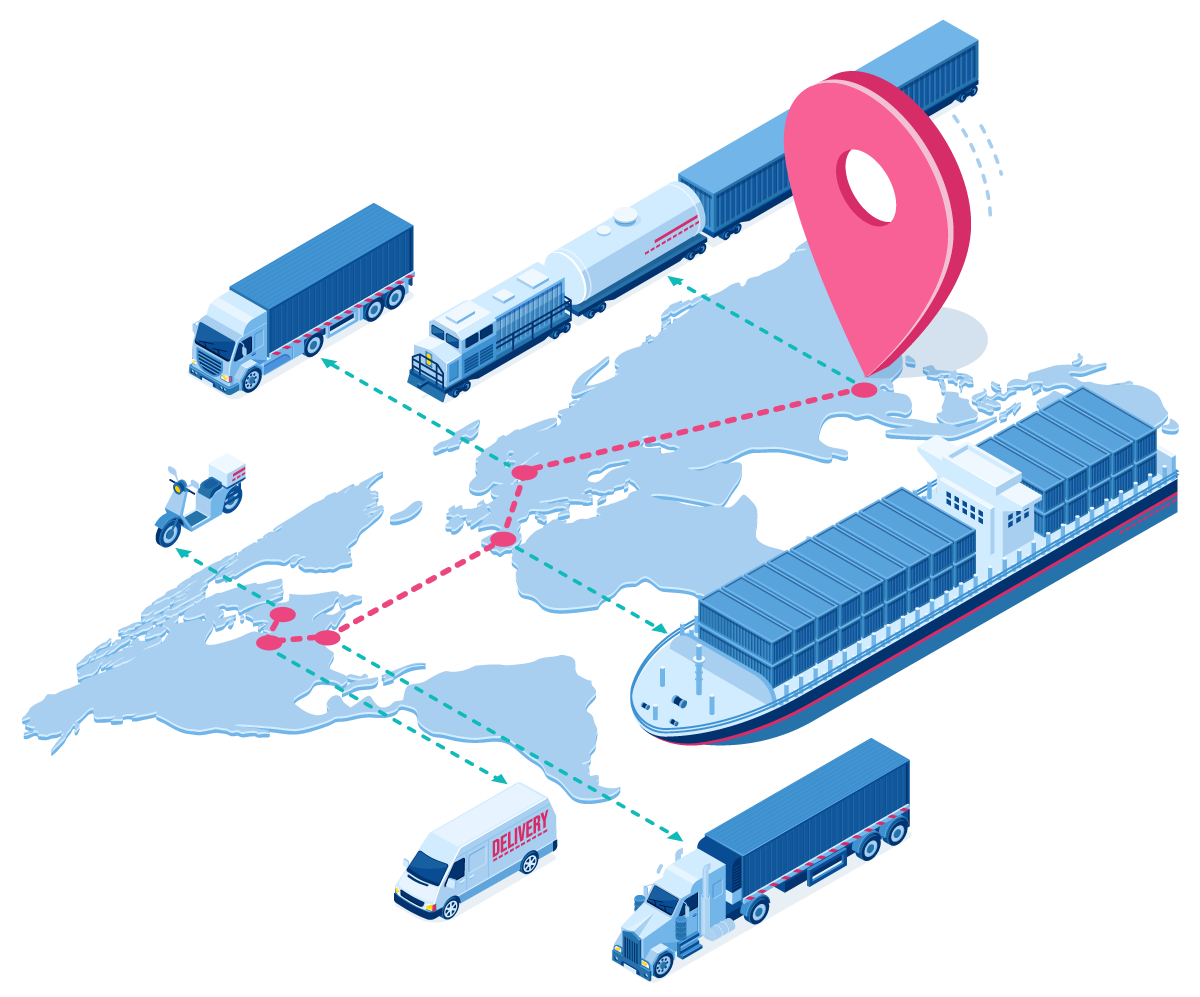

Multi-Modal Transportation

Organisation of multi-modal transportation by sea, road and rail from South-East Asia to northern Europe and the Baltic states.

Insurance

Cargo insurance, consolidation and storage of goods in the warehouses of our partners.

Partners

We ensure fast orders processing, delivery in time and competitive prices. Our partners are the largest, best trucking companies and customs warehouses.

News

Suez Canal Traffic Still 60% Below Pre-Crisis Levels After 100 Days

12.01.2026

More than three months after the last reported attack in the Red Sea, transit through the Suez Canal remains severely constrained, according to BIMCO.

In the first week of 2026, vessel passages were still around 60% lower than in the same period of 2023, before large-scale diversions via the Cape of Good Hope began.

Despite Houthi announcements about halting attacks, the market remains cautious. Since January 2024, quarterly deadweight volumes transiting the canal have consistently stayed 51–64% below 2023 levels, with little change throughout 2025.

Container shipping has been hit the hardest:

- Q4 2025 container ship transits were 86% below pre-crisis levels

- Bulk carriers: –55%

- Crude oil tankers: –32%

- Product tankers: –19%

Product tankers stand out as a partial exception, as higher freight premiums have encouraged some return to the route. Container lines, however, largely continue to rely on alternative routings, though a few operators have signaled a gradual return, conditional on sustained security improvements.

Another potential catalyst is the decline in Red Sea war risk insurance premiums, now down to around 0.2% of hull value, the lowest level since late 2023.

According to BIMCO, a full normalization of Suez transit would reduce operating costs for shipowners — but also lower demand for tonnage. If the route fully reopens, demand for container ships could fall by around 10%, while other segments may see a 2–3% decline, making the pace of recovery a key factor for overall market balance.

BIMCO, founded in 1905, is the world’s largest international shipping association, representing shipowners, operators, and charterers across the global maritime industry.

China Revives Bankrupt Shipyard Under New Ownership

05.01.2026

China Revives Bankrupt Shipyard Under New Ownership

China’s shipbuilding sector continues to expand capacity by restarting assets shut down after the previous downturn, rather than building new facilities from scratch.

A recent example is Nanjing Dongze Shipyard on the Yangtze River, which has resumed operations following a court-ordered sale and a change of ownership. The yard, previously independent and focused on small cargo vessels, ceased operations in 2017 and accumulated around $50 million in debt by 2025, entering bankruptcy reorganization.

The asset was acquired by a subsidiary of China Merchants Shipbuilding Industry Group, which assumed $33 million in liabilities. In return, the buyer gained ready-made infrastructure:

- two slipways up to 50,000 dwt

- production facilities

- valuable riverfront access on the Yangtze

These assets complement the capacity of the nearby Jinling Shipyard.

Under its new brand, the shipyard has already launched its first newbuild — the chemical tanker SC Emerald.

The deal highlights China’s current industry logic: rapid and cost-effective restoration of existing capacity instead of greenfield construction. With China accounting for over 50% of global shipbuilding and maintaining a solid orderbook, this approach delivers a strong competitive edge.

China Merchants Shipbuilding Industry Group is part of the state-owned China Merchants Group and continues to strengthen China’s global shipbuilding position through consolidation and asset reactivation.

Merry Christmas and Happy New Year!

24.12.2025

Dear Partners,

Warmest wishes for the upcoming Christmas and New Year!

We wish you joyful family moments, warmth, and peace during the holiday season. May the New Year bring confidence, stability, and new professional achievements, and may our partnership continue to grow stronger and more successful.

Thank you for your trust and cooperation — we look forward to many great projects ahead.

Services

Multimodal Transportation

Multimodal freight transportation with Forward is our network of reliable agents around the world. Through direct agreements with major shipping lines, we serve all routes required by our Customers. Our low prices are achieved through extensive shipment volumes, along with our specialized unit’s decade-long experience in dealing with sea, air, and land transportation.

Possible transport combinations:

- sea freight + road freight;

- rail freight + sea freight + road freight;

- sea freight + rail freight;

- air freight + road freight;

- sea freight + air freight.

The benefits of container shipments

A sea container is a universal cargo unit with standard dimensions. A container is the most common and practical transport unit in multimodal shipments. Container goods are transported by different modes of transport from door-to door without excessive transshipment. Containers could be delivered to a Customer by sea, rail, road, or air transport, or any combination of the above. Container goods have a faster handling in transit and within transshipment that results in a lower shipment cost. And the safety of the goods is guaranteed. Strong partnerships with well-known maritime companies and container lines allow us to deliver goods of any category and complexity.

- Sea and rail freight container shipping allows cargo to be delivered safely, regardless of weather conditions;

- Goods are loaded into a container once at the shipper’s, and unloaded at the recipient’s warehouse;

- The sealing of cargoes guarantees an additional layer of safety for the transported goods;

- Our Customer manager provide expert advice and calculate alternative delivery options for the Customer;

- Electronic document management and web-cabinets improve the quality and speed of engagement.

Rail Freight

Our portfolio of Partners include leading rail operators and train & wagon owners.

- We offer a selection of alternative routes of cargo shipments depending on the Customer's desired price, delivery time, and point of destination. Included are fast container trains, group, and carload shipments;

- Rail international and domestic transport;

- FCL and LCL rail freights;

- Transportation of cargoes in special temperature conditions or with the use of specialized containers.

Customs Clearance

We offer customs clearance at all customs offices:

- Assistance in obtaining of required licenses and certificates for import or export.

- Last mile delivery of cleared cargoes.

- Drawing up of requisite licensing and certification documentation.

- Delivery of a cargo released for free circulation to the Customer’s warehouse.

You can be calm

Aside from arranging appropriate vessel we also handle the related formalities along with constant tracking of the shipment while it’s in transit using the sophisticated system empowered by our efficient global partners.

Contact

Location:

Office: 810, Jumeirah Bay X2 JLT, cluster X, Dubai, United Arab Emirates

Alexandr

Executive Director

Mob. +971585733856

Alex.kh@forwarddmcc.ae

Dinesh Vattompadath

Commercial Director

Mob. +971 50 248 7049

Dinesh.V@forwarddmcc.ae